deferred sales trust example

Youve taken risks that reaped rewards. With over 20 years in business Estate Planning.

Deferred Sales Trust Defer Capital Gains Tax

EPT members across the country have closed over 1 billion in assets.

. 3 You create a trust where I determine how funds will be invested 4 I sell my business to your trust and am paid back over 10 years 5 You sell the business to the buyer. The deferred sales trust is the replacement for the private annuity trust. The EPT Deferred Sales Trust website is available to.

The DST is a legal tax-based. HASHTAGS bitcoin btc deferred sales trust example. To date EPTs average case size is 220000000.

Youve worked for years to accumulate wealth. Please give us a call at 800-897-0212 or request your free DST. Lets further assume asset growth of 6 and a surviving spouse living another 12 years.

A deferred sales trust is a third-party entity managed by a trustee who will purchase the home from the original owner through an installment sales contract. Tax and trusts estates. By Greg Reese Certified Trustee for the Deferred Sales Trust.

The deferred sales trust specialists at Freedom Bridge Capital would be happy to speak with you to see if a DST is right for you. Today we bring you Part 2 of our series covering the Deferred Sales Trust DST. This also works for owner.

By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. The trustee is then tasked with. The Deferred Sales Trust is not new nor is it an untested structure.

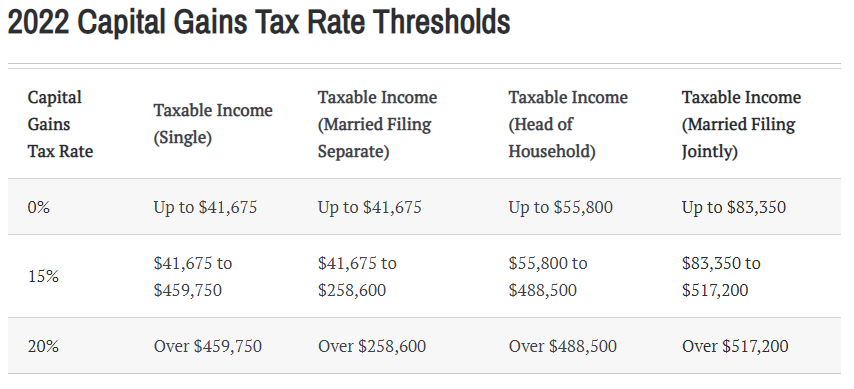

Or perhaps youve come into. 5000000 sale 1000000 dollar cost basis 4000000 gain subject to taxes federal tax 20 california state 133 capital gains taxes vary by state and tax bracket medicare. Steve sells his 19M property and uses a deferred sales trust 443 views Jul 8 2020 5 Dislike Share Save Capital.

The same structure was written about in 1986 by the Harvard Law Review stating This is an example of the time value. Thats where the Deferred Sales Trust comes in. Gross Profit Ratio Gross profit Sale price A basic example would be if someone bought a property for 200000 and they sold it after its value increased to 1000000.

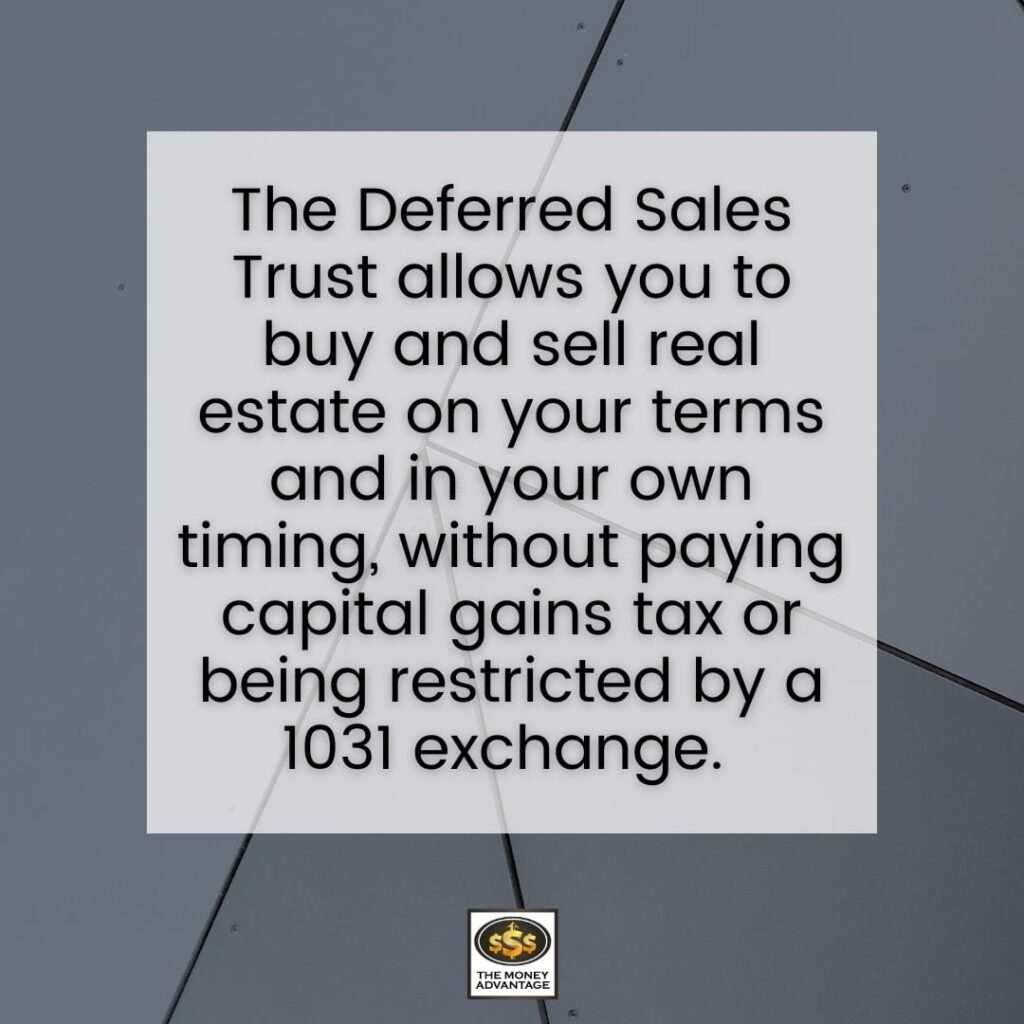

As in a private annuity trust title is transferred to the trustee who then sells the property and puts the. Its called a Deferred Sales Trust and it allows an investor an option to time the market cycles and not be tied to the traditional time constraints of the 1031 Exchange. Estate Planning Team provides exclusive access to market our proprietary capital gains tax deferral strategy the Deferred Sales Trust.

Youve spent decades building your business. For example lets assume the deceased spouse died when the exclusion was 549 million.

Is The Legal Fee For The Deferred Sales Trust Worth It

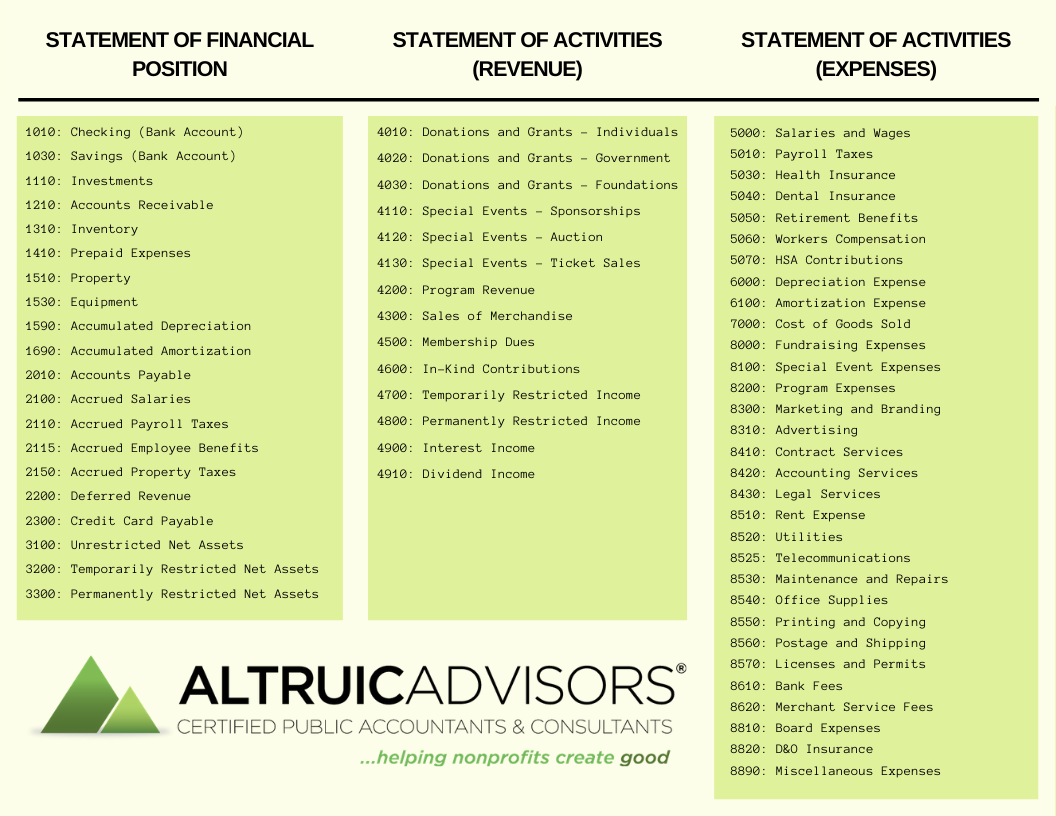

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors

How Can I Find A Deferred Sales Trust Example Youtube

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Defer Capital Gains Tax

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Capital Gains Deferral

Deferred Sales Trust Real Estate Tax Strategy

![]()

Deferred Sales Trust Defer Capital Gains Tax

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

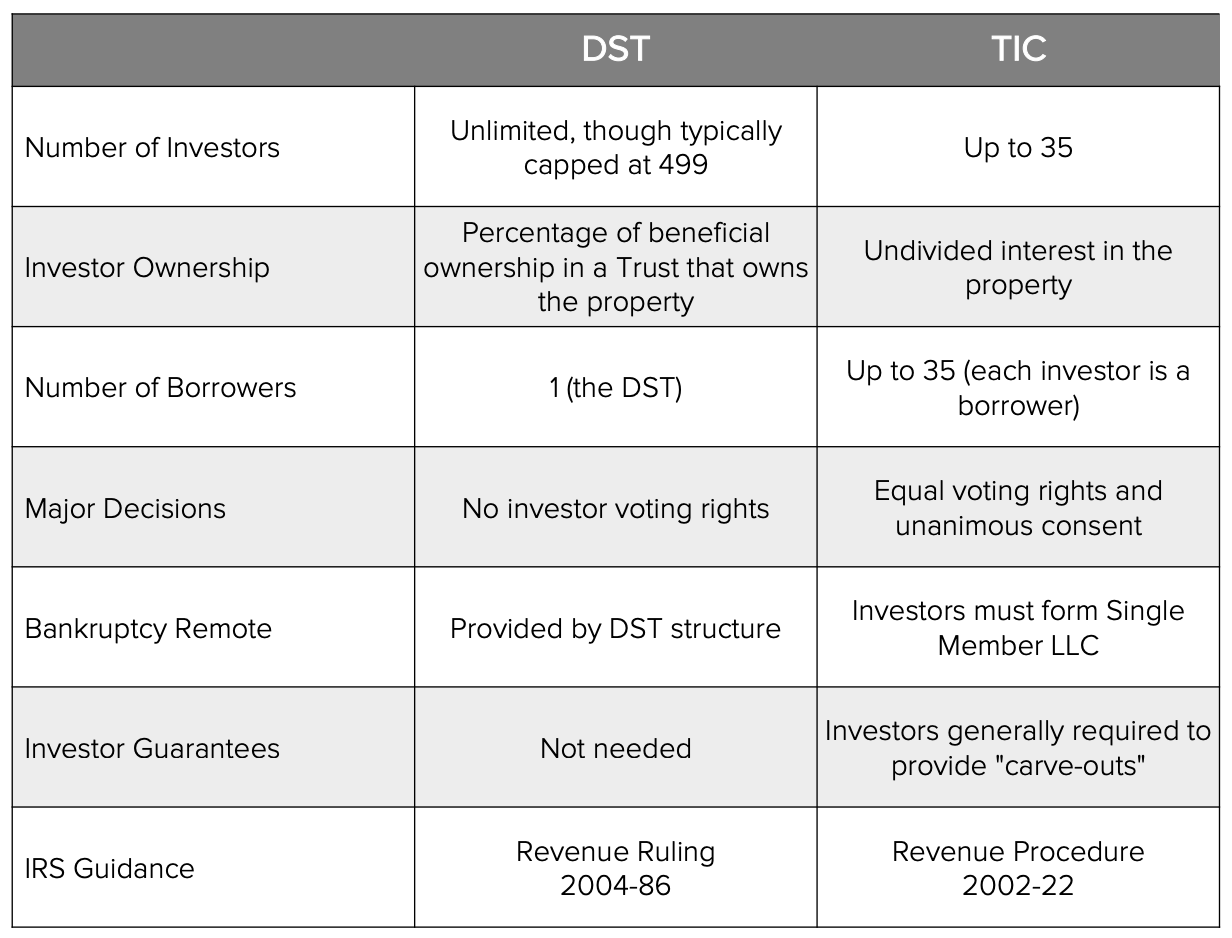

Delaware Statutory Trusts A Comprehensive Guide With Pros And Cons

![]()

Deferred Sales Trust Atlas 1031

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

How To Account For Deferred Revenue 6 Steps With Pictures

Employee Ownership Trusts Key Facts

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Deferred Sales Trust A Tax Strategy For Investors Fortunebuilders